GST Registration Online : Overview

GST Stands for Goods & Services Tax, Launched on 1 July 2017, the Goods &

Services Tax (GST) applies to all Indian service providers (including freelancers), traders and

manufacturers. A variety of Central taxes like Service Tax, Excise Duty, CST and state taxes like

Entertainment Tax, Luxury Tax, Octroi, VAT are accumulated in the GST. Also, taxpayers with a turnover

of less than ₹1.5 crore can choose a composition scheme to get rid of tedious GST formalities and pay

GST at a fixed rate of turnover.

Every product goes through multiple stages along the supply chain, including

purchasing raw materials, manufacturing, selling to the wholesaler, selling to the retailer and then the

final sale to the consumer. Interestingly, GST will be levied on all of these 3 stages. Let’s say if a

product is produced in West Bengal but is being consumed in Uttar Pradesh, the entire revenue will go to

Uttar Pradesh.

Types Of GST

There are primarily four types of Goods and Services Tax (GST):

- Central Goods and Services Tax (CGST): CGST is levied by the central government on the supply of

goods and services within a state. The revenue generated from CGST is retained by the central

government.

- State Goods and Services Tax (SGST): SGST is imposed by the state government on the supply of goods

and services within a state. The revenue collected from SGST is retained by the respective state

government.

- Integrated Goods and Services Tax (IGST): IGST is applicable to the supply of goods and services

between different states or union territories. It is levied and collected by the central government,

and the revenue is then divided between the central and state governments based on predetermined

sharing mechanisms.

- Union Territory Goods and Services Tax (UTGST): UTGST is similar to SGST but is applicable to the

supply of goods and services within union territories of India. The revenue generated from UTGST is

retained by the respective union territory government.

These four types of GST work in conjunction to create a unified tax system,

simplifying taxation procedures and promoting economic integration across states and union territories

in India.

Mandatory Documents For GST Registration

The mandatory documents required for online GST registration in India may vary

based on the type of business entity, such as a proprietorship, partnership, company, or trust. However,

here are the common documents generally required for GST registration:

-

Proprietorship:

- PAN Card of the proprietor.

- Aadhaar Card of the proprietor.

- Identity proof and address proof of the proprietor (same as mentioned earlier).

- Ownership documents of the business premises (property papers or NOC from the landlord).

- Bank account proof of the proprietorship.

-

Partnership Firm:

- PAN Card of the partnership firm.

- Aadhaar Card of all partners.

- Identity proof and address proof of all partners (same as mentioned earlier).

- Partnership Deed.

- Bank account proof of the partnership firm.

-

Company (Private Limited, Public Limited, etc.):

- PAN Card of the company.

- Aadhaar Card of the authorized signatory.

- Identity proof and address proof of the authorized signatory (same as mentioned earlier).

- Certificate of Incorporation.

- Memorandum of Association (MOA) and Articles of Association (AOA).

- Board resolution authorizing the authorized signatory.

- Bank account proof of the company.

- Digital Signature Certificate (DSC) of the authorized signatory.

-

Limited Liability Partnership (LLP):

- PAN Card of the LLP.

- Aadhaar Card of the designated partner.

- Identity proof and address proof of the designated partner (same as mentioned earlier).

- LLP Agreement.

- Bank account proof of the LLP.

- Digital Signature Certificate (DSC) of the designated partner.

-

Trust or Society:

- PAN Card of the trust or society.

- Aadhaar Card of the authorized signatory.

- Identity proof and address proof of the authorized signatory (same as mentioned earlier).

- Registration certificate under the applicable trust or society laws.

- Bank account proof of the trust or society.

GST Registration Process

Applying for GST is a very seamless process, just follow the steps:

- Visit the GST Portal and select new Registration

- Fill in complete details like your business name, PAN Card, state etc

- Enter your Otp sent on your phone then click proceed

- Note down your Temporary Reference Number(TRN)

- Go to GST portal again and select register in the taxpayers

- Enter your TRN which you have noted earlier and click on proceed

- Enter the OTP sent on your registered mobile number or on your email and then click on proceed

- You can check the status of your application in the next page

- Fill in your necessory details and upload documents

- Submit your application after verifying One of Three methods given there

- Finally, you will receive the Application Refrence Number(ARN) on your registered mobile number and

email ID

- Now you can access the status of your ARN on the GST portal

Once your registration has been approved, the GST officer will verify your

application and other required papers for GST registration before issuing you your GST registration

certificate and GSTIN. Remember that the GST certificate may be accessed from the GST Portal and that no

paper copies of the certificate will be issued.

Who Needs a GST Registration Service?

- Businesses with a turnover above the threshold: If your business earns more than a certain amount

annually

(typically around INR 40 lakhs), you need to register for GST.

- Inter-state businesses: If you sell goods or services between different states in India, GST

registration is

mandatory for you.

- Casual taxable persons and non-resident taxable persons: If you occasionally do business in a

different state

where you don't have a regular presence, you need to register as a casual or non-resident taxable

person.

- Input Service Distributors (ISDs): If you receive invoices for services and distribute the tax

credit to your

branches or units, you must register for GST.

- E-commerce operators and aggregators: If you run an online platform that helps sell goods or

services, you have to

register for GST, regardless of your sales volume.

- Agents of a supplier: If you act on behalf of a registered taxpayer, you need to get GST

registration.

- Individuals liable to pay tax under reverse charge mechanism: If you are responsible for paying tax

on specific

goods or services, you must register for GST.

- Sellers on online marketplaces: If you sell goods or services through online marketplaces, GST

registration is

required.

- Manufacturers and service providers: If you manufacture goods or provide taxable services, you need

to register

for GST.

- Exporters: If you export goods or services from India, GST registration is necessary.

- Importers: If you import goods or services into India, you must register for GST.

- Entities supplying goods or services to SEZ units or developers: If you supply goods or services to

Special

Economic Zones (SEZs), you need to register for GST.

- Input Service Distributors: If you receive services and distribute the tax credit to your branches

or units, GST

registration is mandatory.

- Non-resident online service providers: If you are a foreign business offering online services to

customers in

India, you must register for GST.

- Entities engaged in the sale of goods or services liable for reverse charge: If you sell goods or

services subject

to the reverse charge mechanism, GST registration is required.

What is a GST Certificate?

A GST Certificate is an important document issued by the Indian government to

businesses that have registered under the Goods and Services Tax (GST) system. It acts as proof that a

business is officially registered under GST. The certificate includes key information such as the

business's unique GST identification number, legal name, and address.

Having a GST Certificate is crucial for businesses as it allows them to legally

charge and collect GST from their customers. It serves as evidence that they are following the GST

regulations. The certificate is not only used for collecting GST but also serves other purposes. For

instance, businesses need it to claim input tax credits, which helps reduce the tax they pay on their

purchases. It is also required when applying for loans or participating in tenders issued by the

government.

Tax rates for GST

In India, a value-added tax known as goods and Services Tax (GST) is levied on the

supply of products and services. The following are India's GST tax rates:

- 0% - This rate is applicable for essential items such as fresh fruits and vegetables, milk, bread,

and healthcare services.

- 5% - This rate is applicable for items such as processed food, tea, coffee, coal, fertilizers, and

some transportation services.

- 12% - This rate is applicable for items such as clothing, footwear, frozen meat products, butter,

cheese, and some other goods and services.

- 18% - This rate is applicable for items such as mineral water, hair oil, soap, toothpaste, capital

goods, and most services.

- 28% - This rate is applicable for items such as luxury cars, tobacco products, aerated beverages,

and high-end consumer goods.

There are also specific rates for certain goods and services, such as 1% for

affordable housing and 3% for gold and other precious metals. Additionally, some items are exempt from

GST, including unprocessed food items, educational services, and healthcare services.

It's necessary to remember that GST rates are subject to change and may alter based

on the kind of goods or services being offered. Before making a purchase or providing a service, it is

usually a good idea to check the current GST rates.

You can check the tax rates for all the products here:

https://cbec-gst.gov.in/gst-goods-services-rates.html

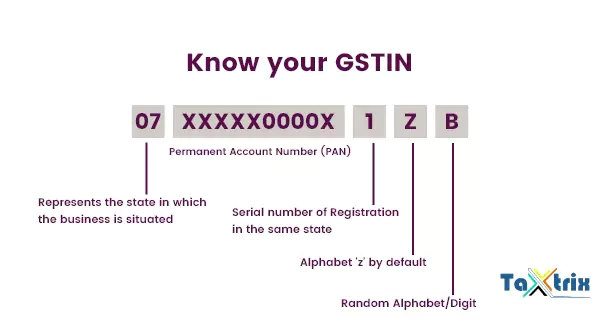

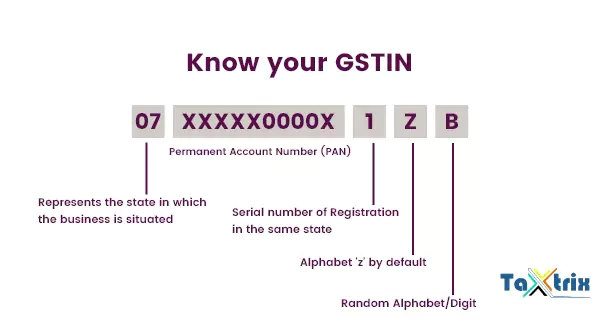

What is GSTIN

GSTIN stands for Goods and Services Tax Identification Number. It is a unique

identification number assigned to every business or taxpayer registered under the Goods and Services Tax

(GST) regime in India. GSTIN is a 15-digit alphanumeric code that is used to track and identify

registered taxpayers for compliance and administrative purposes.

The format of a GSTIN is as follows:

- First two characters represent the state code as per Indian Census 2011. Next ten characters are the

PAN (Permanent Account Number) of the taxpayer.

- The thirteenth character indicates the entity type of the taxpayer (like individual, company,

partnership firm, etc.).

- The fourteenth character is a default "Z" value.

- The fifteenth character is a check digit used for verification purposes.

What is GSTN (Goods and Service Tax Network)

The Goods and Service Tax Network (or GSTN) is an unincorporated, section 8

(non-profit), private limited business. For all of your indirect tax needs, GSTN is a one-stop shop. The

Indirect Taxation Platform for GST is maintained by GSTN, who can assist you with the preparation,

filing, correction, and payment of your indirect tax responsibilities.

Penalties For Failure of GST Registration

All taxable persons who fail to register for GST online in India are subject to a

direct fine under Section 122 of the CGST Act.

-

Late Filing Penalties:

- A specific amount per day of delay in filing GST returns, subject to a maximum cap or a

percentage of the tax liability for the period.

-

Non-Filing Penalties:

- Failure to file GST returns within the prescribed due dates can lead to penalties, including

fines and interest on tax dues.

-

21 Offenses and Penalties:

Under GST, certain specific offenses are identified, and penalties are prescribed for each offense.

Some of these offenses and their respective penalties include:

A. Incorrect GST Return Filing:

- Penalty: A specified amount or a percentage of the tax amount under-reported or over-claimed.

B. Fraudulent GST Input Tax Credit (ITC) Claims:

- Penalty: Amount equal to the wrongfully claimed or utilized ITC, along with interest and

possible prosecution.

C. Failure to Obtain GST Registration:

- Penalty: A sum equal to 100% of the tax due or a specific amount per day of non-registration,

subject to a maximum limit.

D. Issuing Fake or Incorrect GST Invoices:

- Penalty: A specified amount or a percentage of the invoice value, subject to a maximum limit,

along with possible prosecution.

E. Supplying Goods/Services Without Proper Invoice:

- Penalty: A specified amount or a percentage of the invoice value, subject to a maximum limit.

F. Obstructing or Falsifying Documents:

- Penalty: A specified amount or imprisonment, or both, depending on the severity of the offense.

G. Failure to Maintain Proper Books of Accounts:

- Penalty: A specified amount or imprisonment, or both, depending on the severity of the offense.

Please note that these are examples of offenses and penalties. The actual penalties may vary

depending on the specific circumstances and provisions under the GST Act.

How Can We Help You - Why Taxtrix?

Here are the top most reason to choose us are:

- Easy to get GST registration services and GST number online

- Compliances are hassle-free since we take full charge of them.

- All your GST returns will be filled duly

Our staff is here to answer any questions you may have and to guide you through the

entire GST registration procedure.

The GST Dictionary

Goods and Services Tax (GST): A value-added tax levied on the

supply of goods and services in India, which has replaced multiple indirect taxes levied by the central

and state governments.

Input Tax Credit (ITC): The credit that a registered taxpayer can

claim for the GST paid on inputs (purchases) used in the course of business. It can be utilized to

offset the tax liability on output supplies.

GSTIN: Goods and Services Tax Identification Number, a unique

15-digit alphanumeric code assigned to each taxpayer registered under GST for identification and

compliance purposes.

CGST: Central Goods and Services Tax, the component of GST that is

levied by the central government on intra-state supplies of goods and services.

SGST: State Goods and Services Tax, the component of GST that is

levied by the state government on intra-state supplies of goods and services.

IGST: Integrated Goods and Services Tax, the component of GST that

is levied by the central government on inter-state supplies of goods and services and imports.

Taxable Person: An individual or entity that is registered or

required to be registered under GST and liable to pay GST on the supply of goods and services.

Composition Scheme: A simplified scheme available to small

taxpayers with a turnover below a certain threshold, allowing them to pay GST at a lower rate and comply

with reduced compliance requirements.

E-Way Bill: An electronic document generated for the movement of

goods worth a specified value from one place to another. It ensures the seamless movement of goods and

helps track compliance during transit.

Tax Invoice: A document issued by a registered taxpayer to another

party while making a taxable supply of goods or services, containing details of the transaction, such as

GSTIN, description of goods or services, and tax amount.

Place of Supply: The location (state or union territory) where the

supply of goods or services is deemed to have taken place, determining the applicability of CGST, SGST,

or IGST.

HSN Code: Harmonized System of Nomenclature code, a standardized

international system for classifying goods, used to determine the rate of GST applicable to specific

products.

Reverse Charge Mechanism (RCM): A mechanism where the recipient of

goods or services is liable to pay GST instead of the supplier. It is applicable in certain specified

cases, shifting the tax liability to the recipient.

Annual Return: A comprehensive summary of a taxpayer's GST

transactions and financial information for a financial year, which needs to be filed by registered

taxpayers.

Tax Deducted at Source (TDS): A provision where the specified

categories of persons are required to deduct a certain percentage of GST from payments made to suppliers

and remit it to the government.