Online Company PVT LTD Company Registration: Overview

A PVT LTD company is one of the most famous business entities that is owned and

operated by an individual or a group of people. It provides its shareholders with limited

liability while imposing certain ownership restrictions.Moreover, In LLP partners operate the

company while in Private limited company shareholders and directors act as a separate

entity.

Private Limited Company registration has played a significant role in the growth of

startups in India today. The Indian startup ecosystem has seen exponential growth in

the past few years (2015-2022), with a 15x increase in the total funding of startups,

also implying there are 2-3 tech startups born every day. Majorly incorporated in

Private Limited Company, these startups are helping in improving the GDP of india.

Hence, various government aided schemes are introduced there to help them grow.

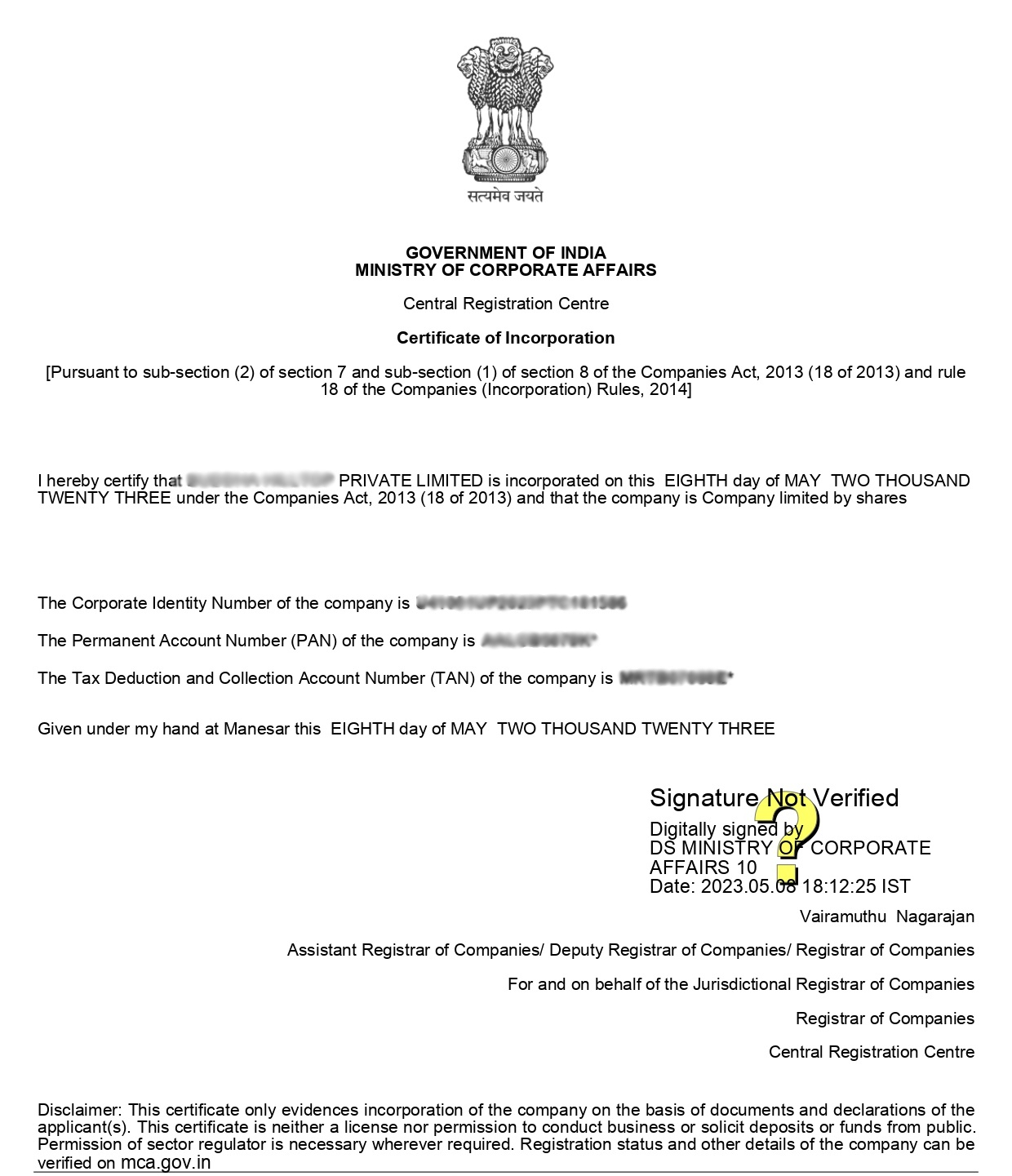

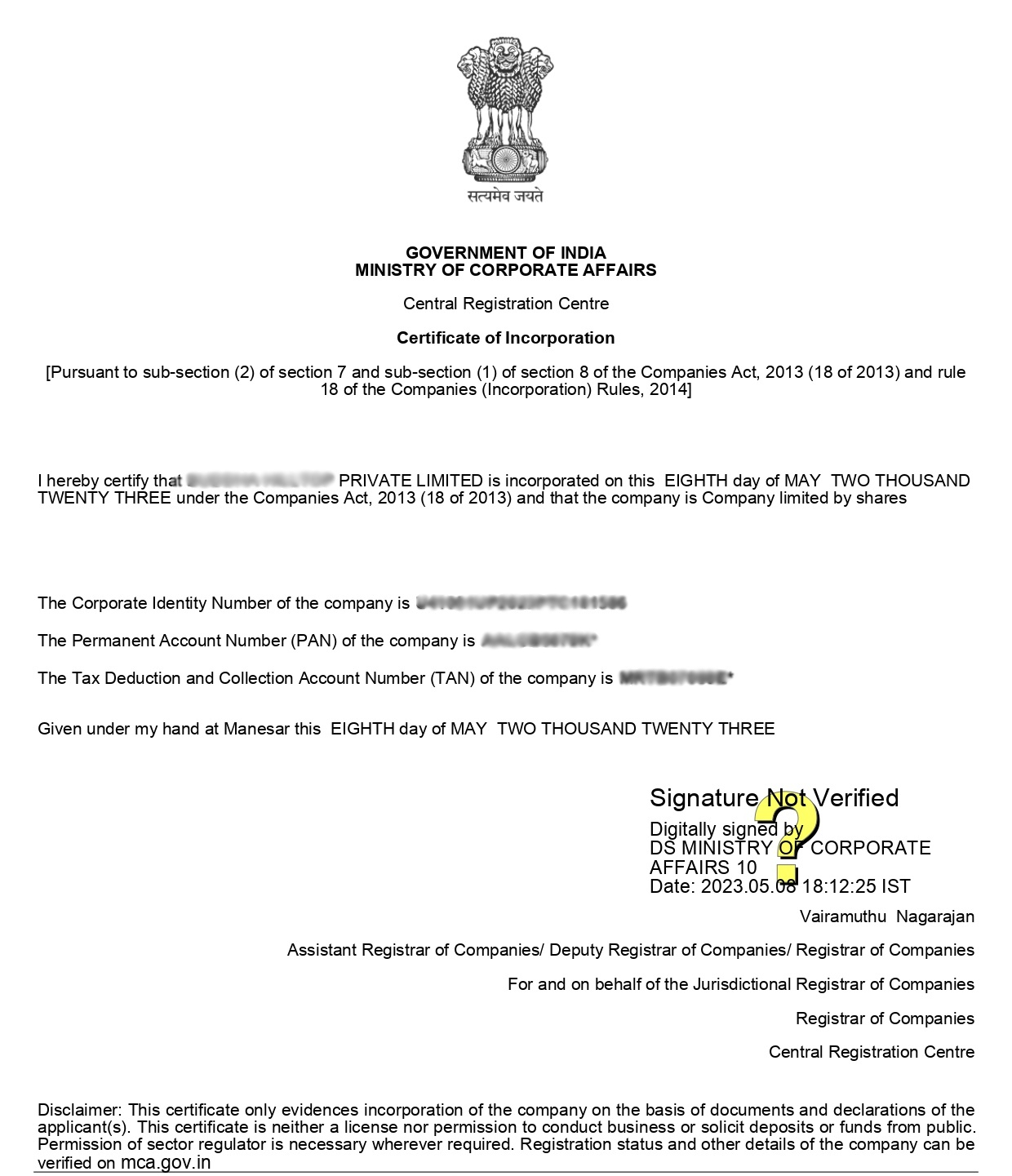

Pvt Ltd Company Incorporation Certificate [Sample]

Benefits of Pvt Ltd Company Registration

There are so many advantages of registering a company. Registering a business build credibility of your business, which can help in growing your customer trust. Company Registration also provide more benefits that can help your business grow and succeed.

Let's see some of the benefits of private limited company registration.

- Private Limited Company improves credebility by being registered as a corporate entity.

- It helps to Increase the potential to grow big

- Pvt Ltd Company is a legal entity in its own rights that allow business owners to keep their personal assets seperate from the business. Therefor, Business owners are not subject to any personal libility.

- It Build Customer Trust

- It helps Attract New People

- Limited Liability Protection helps in protecting personal assets of owners.

- Easy Exit Plan

- Easy Transferbility

Pvt Ltd Company Registration Process

India has emerged as the third-largest ecosystem for startups globally with over 99,000 DPIIT-recognized startups across 670 districts of the country as of May 31, 2023. By registering the company your startup can have a competitive advantage over the non-registered companies. With the complexity of the required documents and compliances, these growing startups require a reliable adviser for such business requirements on each step. Our team of professionals having the right skills and knowledge can help you out with Pvt Ltd registration.

- 01Apply for DSC (Digital Signature Certificate)

It is necessary to get a Digital Signature Certificate from the government as part of the business incorporation procedure for the online company registration. A DSC, or Digital Signature Certificate, serves as confirmation of identification for the company's directors and is necessary to sign digital paperwork when applying for company registration online.

- 02Reservation for unique name

The next step after getting DSC is to Reservation of unique name for your firm and ensure that it is not identical or similar to any existing registered business, as specified in Rule 8 of the company Incorporation Rules.

- 03Filling SPICe Form (INC-32)

After the name approval, The firm registration data must be submitted in the SPICe+ form on the MCA portal. It is a complete Proforma to establish a private limited business. You must complete all of the information shown below.

- * Fill in the details of company, members and subscribers

- * Apply for Director Identification Number (DIN)

- * Apply for PAN and TAN

- * Declarttion by Directors and Subscribers

- * Declaration and certification by professionals

- 04Filling MoA and AoA

The forms that must be completed while submitting for online business registration in india are SPICe e-MoA (INC-33) and e-AoA (INC-34). MoA is defined in section 2(56) of the Companies Act, 2013, which describes the company's aims and goals, while AoA is defined in section 2(5) of the Companies Act, 2013, which describes the company's internal functioning and management structure.

- 05Issuance of PAN, TAN and Certificate of Incorporation

After Following clearance from the Ministry of Corporate Affairs of the aforementioned papers, the department will provide documents such as PAN, TAN, Certificate of Incorporation, and so on.

Register your pvt ltd company with Taxtrix

Registering your company as a Private Limited Company can be a complex process, requiring adherence to several compliance regulations. At Taxtrix, we specialize in simplifying this entire registration process for you. Experience a hassle-free company registration by following these 3 easy steps:

Step: 1

Get in touch with us via Calling us, Email Or Contact Form

Step: 2

Provid the necessory documents which is required for this

Step: 3

Get your company registered in 7 working days .

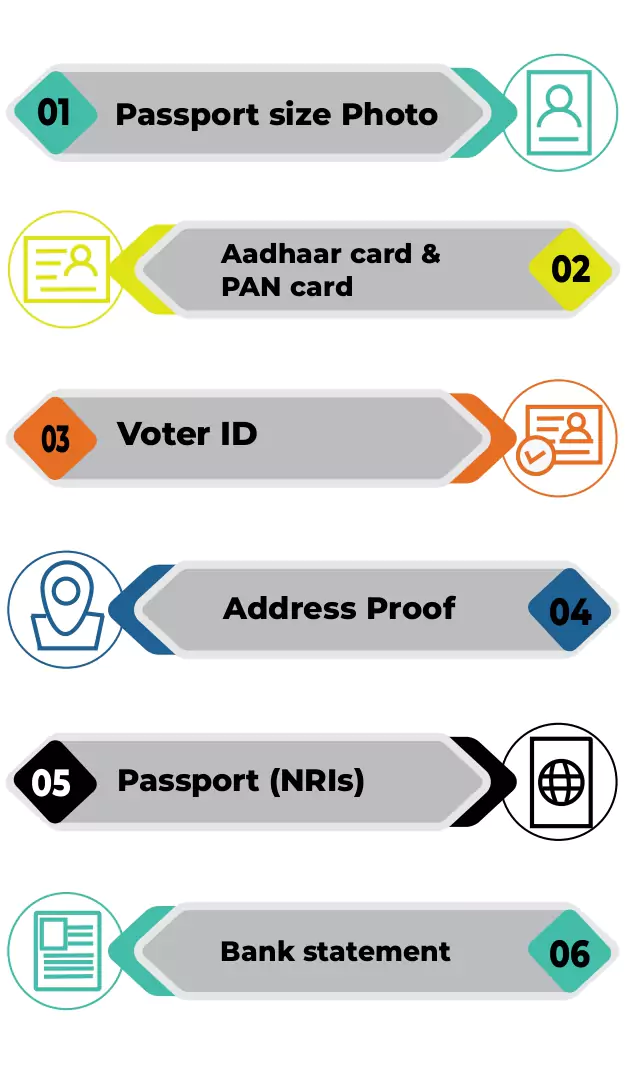

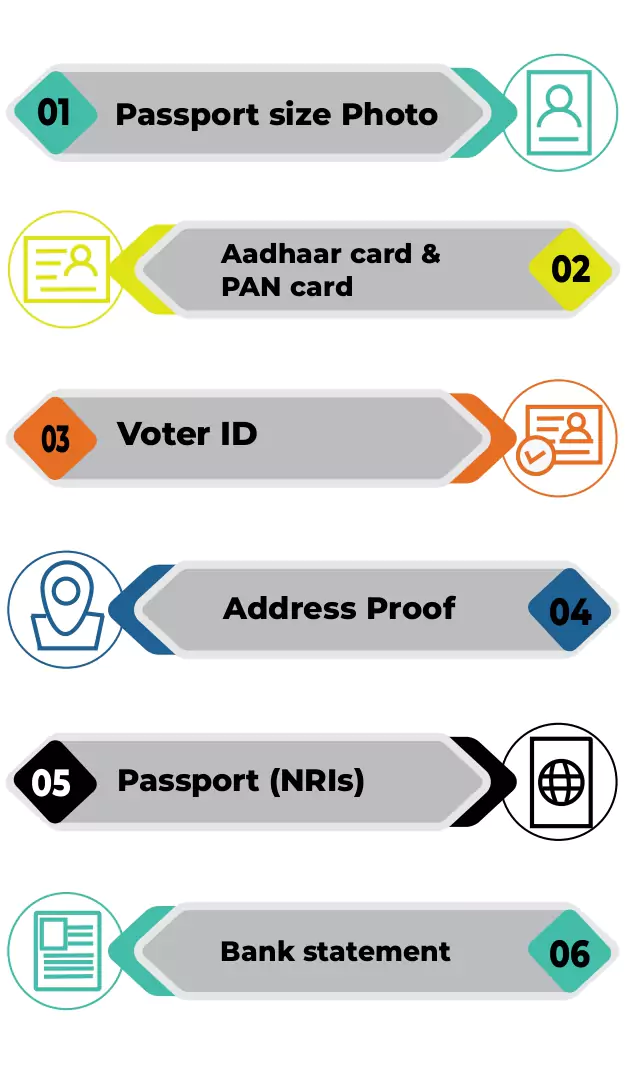

Documents Required for Online Company Registration

To register a private limited company in India, proper identity and address proof must be provided. These documents are mandatory for both directors and shareholders and need to be submitted to the Ministry of Corporate Affairs (MCA) portal.

Identity, address proof required for directors and shareholders of Indian private limited company.

- Passport-sized photographs of the directors.

- Copy of Aadhar Card

- Copy of Driving License or Voter ID

- Copy of PAN Card

- A recent bank statement or utility bill copy (within two months).

- A copy of the passport is required for foreign nationals or NRIs.

Address proof for the registered office

- A copy of an electricity or utility bill (not more than two months old) is required as the address proof for the registered office.

- In case the registered office is rented, a rent agreement is required as proof.

- NOC (No Objection Certificate) from the owner of the property

Note: Incorporation does not mandate owning a commercial business premise. Home address proof can be utilized for company registration.

Pvt Ltd Company Registration Fees

The registration cost for a Private Limited Company in India, inclusive of government and professional fees, begins at Rs.4,999. The process typically takes approximately 7-10 working days.

| Steps |

Fees (Rs.) |

| Digital Signature Ceryificate Fess |

Rs. 2,400 |

| Government Fee |

Rs. 1,600 |

| Professional Fee |

Rs. 999 |

| Total Fee |

Rs. 4,999 |

The Dictionary Of Pvt Ltd Company

Amendment

Amendment to the articles of incorporation of a domestic corporation can involve the addition, deletion, or modification of existing provisions.

Board of Directors

The directors, elected by the shareholders, form the governing body of a corporation. They hold the responsibility of appointing officers, overseeing the corporation, and exercising general control over its operations.

Certificate of Incorporation (COI)

The document filed in many states to establish a corporation is commonly referred to as the Certificate of Incorporation. It is also known by the name Articles of Incorporation.

DSC

The Digital Signature Certificate (DSC) is an electronic instrument issued by certifying authorities that enables individuals to sign electronic documents securely. Since all the required documents for registration are in electronic format, the DSC plays a vital role in ensuring the authenticity and integrity of these digital documents.

DIN

Director Identification Number (DIN) is a unique identifier for company directors in India, issued by the Ministry of Corporate Affairs (MCA).

Dissolution

The statutory procedure that concludes the existence of a domestic corporation is known as corporate dissolution.

Incorporation

The act of establishing or organizing a corporation under the laws of a particular jurisdiction is referred to as corporate incorporation.

Limited Liability Company (LLC)

A legal entity formed and governed by the laws of the jurisdiction in which it is established is commonly known as a corporation. Limited liability companies (LLCs) are often able to combine the advantage of limited personal liability offered by corporations with the favorable pass-through taxation characteristic of partnerships.

Limited Personal Liability

The protection granted to a corporate shareholder, limited partner, or member of a limited liability company (LLC) from the debts and claims against the company is commonly known as limited liability. This means that the personal assets of the shareholder, limited partner, or member are typically shielded from being used to satisfy the company's obligations or liabilities.

Name Reservation

The process by which a company secures the exclusive right to use a corporate name for a designated period is commonly referred to as name registration or name reservation. This procedure ensures that other entities within the same jurisdiction cannot use the same corporate name during the specified time frame.

Registered Office

The statutory address of a corporation, often the registered agent's address, is the official address required by law.

![]() Guaranteed 7-Day Document Upload to the MCA or Receive a Full Refund .

Guaranteed 7-Day Document Upload to the MCA or Receive a Full Refund .